International payments app Zing, and global digital payments provider, Checkout.com, today announced a partnership to support the launch of a new suite of alternative payment methods integrated into Zing’s app.

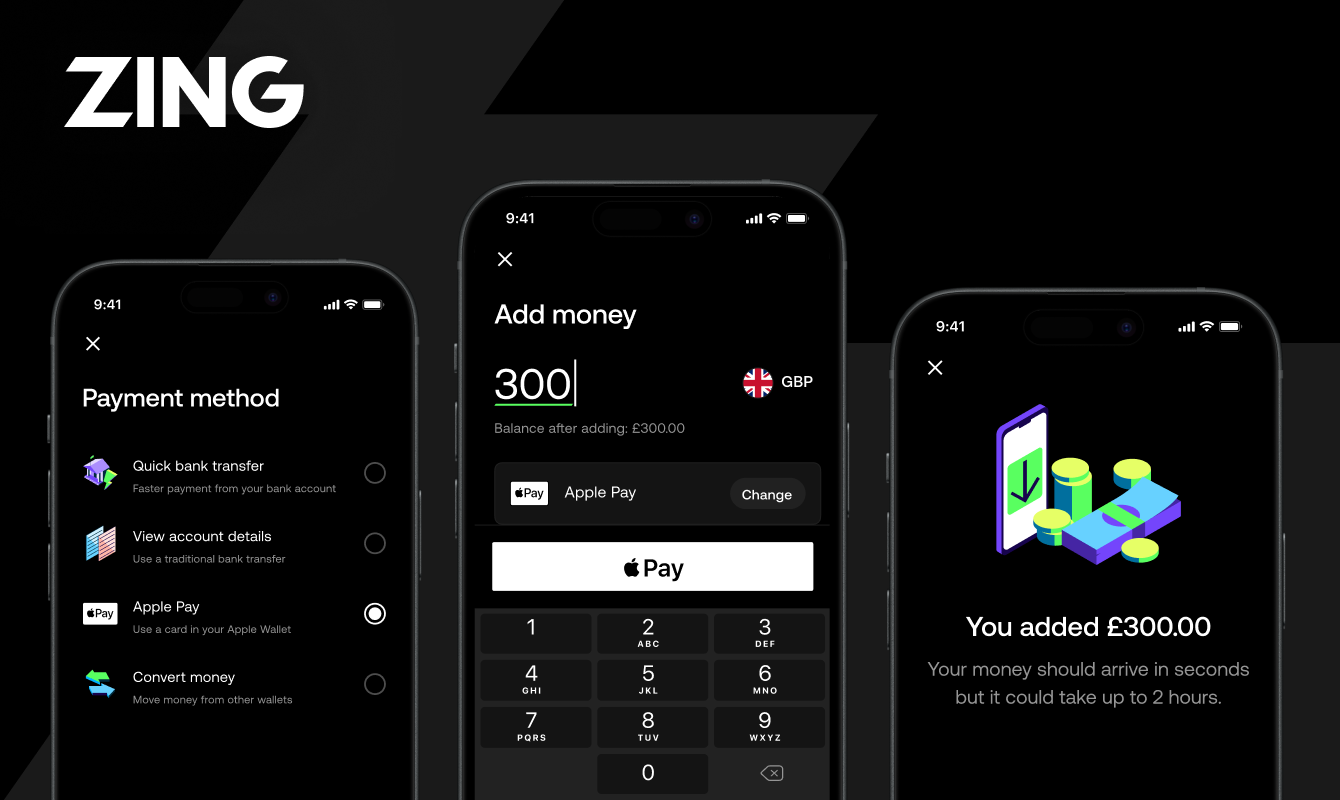

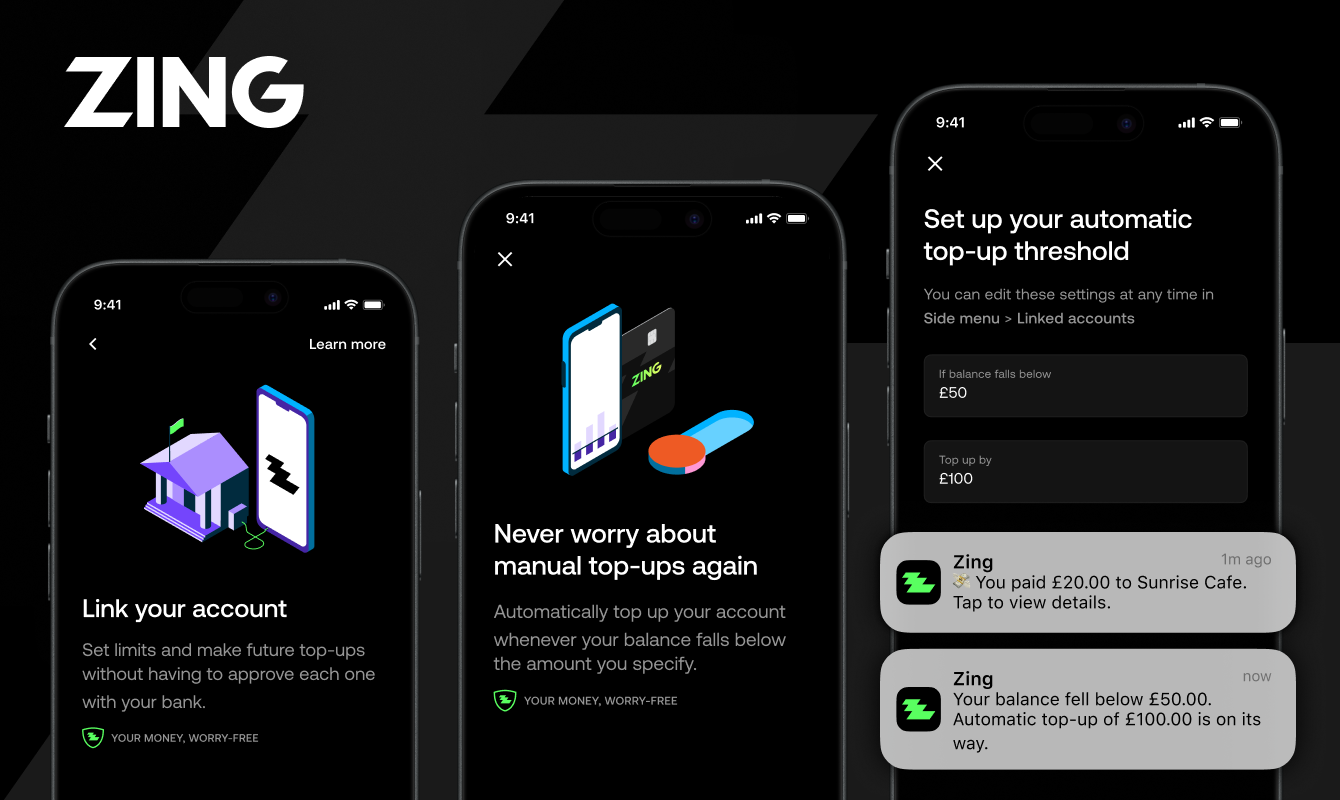

Zing members can now use multiple top-up tools, including mobile wallets, Apple Pay, and Google Pay, made possible by Checkout.com’s global digital payment integration.

The announcement is part of a wider partnership through which Checkout.com will act as Zing’s primary global acquiring partner.

Zing has experienced rapid growth since its launch and has established a strong presence in the UK thanks to its customer-friendly app, which allows members to spend, send, and receive money internationally confidently.

Since partnering with Checkout.com, Zing’s members have transitioned away from traditional card top-ups to newer alternative payment methods. This shift highlights the growing demand for flexible, fast payment solutions – an integral part of Zing’s customer-focused strategy to deliver convenience and simplicity.

This new partnership further enables Zing’s members to enjoy a worry-free global money experience.

Zing is now focused on leveraging Checkout.com’s cutting-edge technology to boost acceptance rates and deliver performance across the payment journey.

With direct acquiring available in more than 55 countries, Checkout.com’s global network will also enable Zing to roll out its services to more markets in the future.

James Allan, CEO and Founder at Zing, comments: “Fundamentally, Zing’s ambition is to give our members the most convenient tool for cross-border payments, making international money worry-free, wherever they are in the world.

“Our partnership with Checkout.com, is, and will continue to enable us to deliver the best experience possible for our members. We’re proud to be working alongside Checkout.com and look forward to further innovation in the future.”

Meron Colbeci, Chief Product Officer, at Checkout.com, comments: “We’re extremely proud to be partnering with Zing as it embarks on this next stage of growth. Zing is a fintech company built from the ground up and is redefining how people manage money both digitally and internationally – a mission that is very aligned with our own.

“A core tenet of our product philosophy is choice, giving customers the ability to customize and tailor solutions to suit their growth objectives. As our customers look to grow their businesses and expand their footprints globally, our goal is to help them navigate the complexity of payments in the markets they need.”

-ENDS-

About Zing

Zing is a free international money app and multi-currency card, both physical and digital, designed to make international money worry-free. Members can hold 20+ currencies, send 30+ currencies, and spend in 200+ countries, as well as exchange money around the world easily, with real-time Interbank exchange rates and no hidden fees.

Zing is an e-money institution (EMI) authorized by the Financial Conduct Authority and part of HSBC.

About Checkout.com

Checkout.com processes payments for thousands of companies that shape the digital economy. Our global digital payments network supports over 145 currencies and delivers high-performance payment solutions across the world, processing billions of transactions annually.

With flexible and scalable technology, we help enterprise merchants boost acceptance rates, reduce processing costs, combat fraud, and turn payments into a major revenue driver. Headquartered in London and with 16 offices worldwide, Checkout.com is trusted by leading brands such as Sony, Shein, Sainsbury’s, Wise, Patreon, GE Healthcare, Rail Europe, and The Financial Times.

Checkout.com. Where the world checks out.

About HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 62 countries and territories. With assets of $3,021bn on 30 September 2023, HSBC is one of the world’s largest banking and financial services organizations.