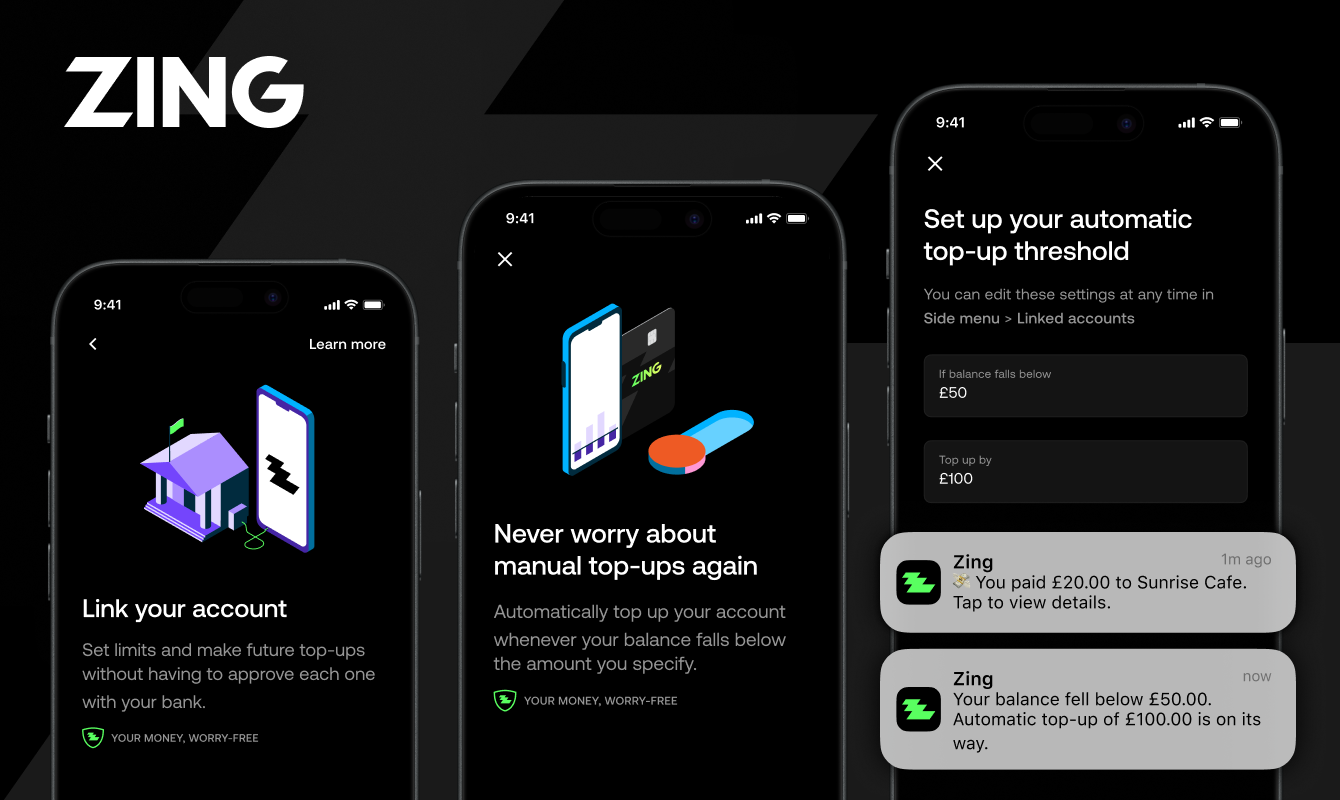

Automatic top-ups, which automatically credit the user’s account when their balance runs low

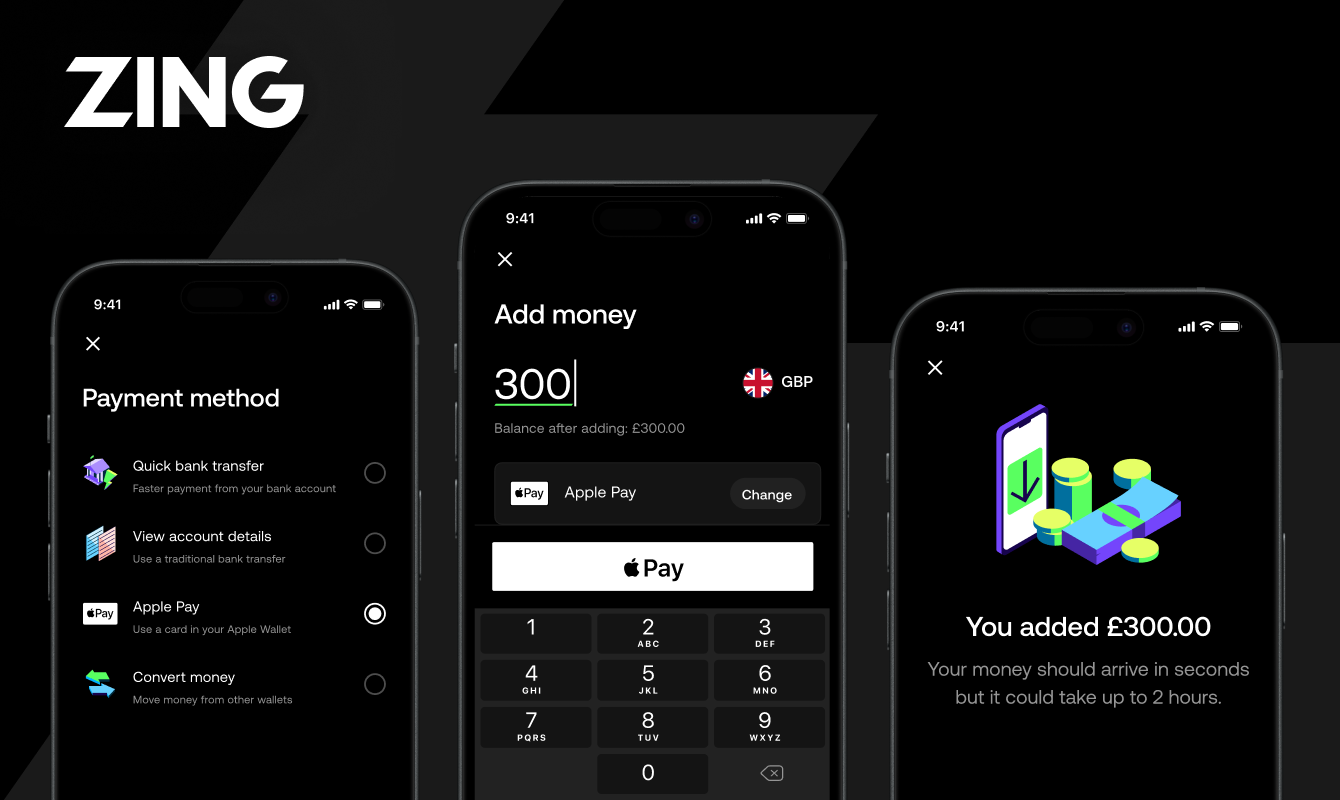

One tap top-ups link Zing to members' banking apps for card-free top-ups

International money app Zing has today rolled out two new frictionless, top-up options for members. Automatic and one tap top-ups will utilise open banking variable recurring payments (VRP) to enable members to add funds from seven major banks within 30 seconds.

The new features will be available for all members thanks to Visa’s open banking platform, Tink. Members can now link their banking app directly to their Zing wallet for fast and automatic top-ups without the need for reconnection every 30 days.

The addition of this technology will continue to accelerate Zing’s rapid growth, having launched in the UK in January 2024. Its growing tech stack enables members to hold 20+ currencies seamlessly, send 30+ currencies, and spend in 200+ countries and territories with a single app and card while knowing their funds are safeguarded and enjoying 24/7 human customer support.

One tap top-ups will utilise linked accounts to enable users to select the amount they want to credit their wallet and do so with just one tap, without manually inputting details or leaving the Zing app, thanks to open banking account linking. By setting a pre-approved monthly limit, each top-up no longer needs to be approved by the user's bank each time a transfer is made.

Automatic top-ups will use the same account linking technology; however, it will enable users to set a minimum balance limit and a maximum automatic top-up value. Once the member's wallet falls below the minimum limit, Zing will automatically top up the wallet by the predetermined value, e.g., ‘When my balance falls below £50, top up £100’.

Both features are available for all members and will work with most of the UK’s major banks, including HSBC, Barclays, Lloyds, Nationwide Bank, NatWest, and Santander.

James Allan, Founder and CEO of Zing, commented: “Our members shared their fears of having their card declined due to insufficient funds when making payments while travelling, holding up the queue as you try to top-up your account.

“With automatic top-ups, members can keep their accounts ready for anything without having to think about topping up, making international money truly worry-free.

“Tink has done an incredible job of enabling us to make our members’ payment experience more streamlined, and we’re looking forward to what we can do next.”

Jack Spiers, Sales Director, Issuing Solutions at Visa, added: “Our partnership with Zing showcases how open banking can reduce complexity for consumers, enabling Zing to offer its members an even more seamless service. It is great to see the traction and impact Variable Recurring Payments now have in the market, moving open banking-powered payments further towards mass-market adoption.”

-ENDS-

Notes to Editor

To find out more about Zing, follow @thezingapp on Instagram, YouTube, Facebook, and Zing on Linkedin.

For more information, contact us at press@zing.me

About Zing

Zing is a free international money app and multi-currency card, both physical and digital, designed to make international money worry-free. Members can hold 20+ currencies, send 30+ currencies, and spend in 200+ countries, and exchange money around the world easily, with real-time Interbank exchange rates and no hidden fees.

Zing is part of HSBC. Zing is not a bank. Zing is an e-money institution (EMI) authorised by the Financial Conduct Authority. Find out what this means to you and more in our FAQs.

About HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 62 countries and territories. With assets of $3,021bn at 30 September 2023, HSBC is one of the world’s largest banking and financial services organisations.